A balance sheet is one of the four most important financial statements an accountant will produce. They are created at the end of an accounting period and can hold pretty significant financial data!

A balance sheet contains financial information on the permanent, or real, accounts contained within your general ledger. These are accounts that don’t get reset to zero in the new financial period. This includes the assets, liabilities, and equity accounts.

Creating a balance sheet – or even understanding why your business needs one – can be a bit of a headache. Hopefully this guide will help you see why your business benefits from balance sheets!

First of all, why does your business need a balance sheet?

The balance sheet is basically the home of the all-important accounting equation:

ASSETS = LIABILITIES + SHAREHOLDER’S EQUITY

Through this equation, a business owner can understand exactly how much his company owns (assets) and owes (liabilities). They will also get an idea of how much the shareholders have invested into the company (equity).

By summarising this information in a single statement, a business owner can better understand the financial position of their business. A balance sheet can help you understand the net worth of your company, whether it is in debt and if it has enough assets to cover accounts payable.

So, a balance sheet tells you specific financial information about how your company has operated over the past financial period. As this data carries on into the next period, it gives you an up-to-date idea of exactly how your business functions.

What kind of information does a balance sheet show?

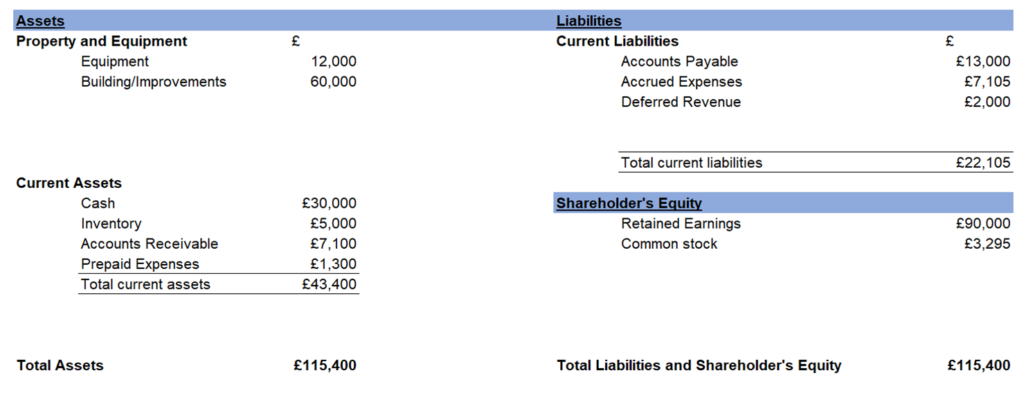

This is where we come back to that all-important accounting equation. In order to represent this information on the balance sheet, it must be broken down into separate sections. Like the equation above, the assets tend to appear in a column on the left-hand side. On the other hand, the liabilities and shareholder’s equity appear on the right-hand side – the sum of which should equal the sum of the assets!

Okay, that’s a lot to take in. You might be left with even more questions too! So let’s break down each component of a balance sheet so you know exactly why they’re necessary.

Assets

Simply put, an asset is anything your business owns that produces (or has the potential to produce) a positive value. This can be split into five main categories: inventory; cash; accounts receivable; short-term investments; and prepaid expenses.

Inventory refers to goods that your business intends to sell as well as materials used in production.

Cash is the most liquid (transferable) asset available to a company. It comes and goes on a day-to-day basis and your company’s ability to generate cash is a significant indicator of its health!

Accounts receivable essentially refers to unpaid invoices. They represent a customer’s intention to pay for an order they have made. With the double-entry bookkeeping method, transactions are recorded when the purchase is made, not when cash exchanges hands. Companies using this method will send out invoices to their clients after they record the transaction to demonstrate the clients obligation to pay. They are recording in the asset account as it is essentially an incoming cash asset.

Short-term investments refer to securities – like debt and equity – that are intended to be sold in the near-future as a means of generating income.

Prepaid expenses are exactly what they sound like! They refer to things like office supplies or insurance which are bought for cash. These expenses are referred to as assets before they are consumed.

There are other types of assets, too, but we won’t bore you with every single one! In their simplest terms, they’re whatever the company owns that might bring in money.

Liabilities

A liability is basically the complete opposite to an asset. Liabilities are whatever your company owes. This can be anything from accounts payable to loans.

Liabilities can be separated into two classifications: current and long-term. A current liability are those anticipated to be resolved within a year. Examples of this might be include wages paid to employees, taxes owed on income or payments to suppliers.

A long-term liability are those that don’t fall under the current liabilities framework of ‘within a year’. Something outside of that period might be a long-term lease of a building or your obligation to repay bank loans.

Shareholder’s Equity

Shareholder’s equity is a little more complicated than the other two. The value of the equity demonstrates the net worth of your business. If you were to imagine that your company’s assets were liquidated and your debt repaid, the remaining amount would be the sum of money distributed amongst the shareholders.

The shareholder’s equity is equal to the total sum of the assets minus the sum of the liabilities – it’s basically the fundamental figure of what your company is worth.

The shareholder’s equity alone is not enough to help you understand your business. This is why a balance sheet is so important.

Bringing together your assets, liabilities and equity on a balance sheet is the best way to understand your net worth and the backbone of your business activity.

What does a balance sheet look like?

Knowing what a balance sheet is and what it should look like are two very different things. That’s why we’ve put together a really basic example so you can see what one might look like.

If you need to hire an accountant to help you create a balance sheet, take a look at Count’s services!

You didn’t start a business to look after you financial data, but we did!